Energy Procurement | Lower Energy Rates

You can now enjoy significant savings on your natural gas bills monthly with US Grid Wholesale’s auction platform.

US Grid Wholesale is focused on bringing you the very best Price, Contract Terms and ongoing Support from Company’s you can trust. We offer our Customers a marketplace that provides a competitive environment and allows you to choose a supplier that fits you best. Pre-qualified wholesale suppliers will bid on your business using a blind auction format. The result is the lowest energy rate at the time of your bid.

Features of this Program

- Cost reductions from 10% to 35% below Utility tariff rates.

- The rate you receive will be specific to your facility and based on your load profile. You will no longer be given higher rates just because you fit into a supplier’s generic service class.

- US Grid Wholesale will monitor market fluctuations and advise you on the best time to lock in.

Rate Plans

- Fixed Rate

- NYMEX Plus Fixed Basis

- Block & Index

- Index w/ Trigger to Fixed

- Financial Hedging

What Are The Benefits

Great Savings

Utility rates in your area continue to rise above national average.

Cost reductions from 10% to 50% below Utility tariffs.

Get Control

YOU determine the product type you will accept.

YOU determine the maximum term length you will accept.

Budget Certainty

Our suppliers offer fixed rates, which provides you with budget certainty on your monthly energy bills. If you desire an index or variable rate, US Grid Wholesale secures you a fixed basis so you can verify what you’re getting.

Industry Knowledge

You receive the very best advice and consultation on both products and current market trends in order to make educated decisions on what’s best for your business.

Product Descriptions

Fixed price – Full Requirements

Companies that require budget certainty and cannot bear price risk will select a fixed price-full requirements pricing strategy. “Full requirements” implies that a customer must take delivery of all of the operation’s power needs at a certain price rate. Most suitable for the vast majority of commercial and industrial companies.

Fixed Price Block with remainder at Index

For companies willing to shoulder some risk but have concerns about letting 100 percent of their energy pricing ride on the index, a block-and-index combination is a good choice. This offers the option of reducing price, while mitigating the risk of variable pricing.This product lends itself well to a growing business that can layer in additional natural gas usage as the business expands. The company can lock in a fixed price up front for a portion of its load and pay the index price for the remaining volumes. This strategy also makes sense if the company wants to lock in portions of the contract price at various times, since the company can buy multiple blocks of natural gas over time.

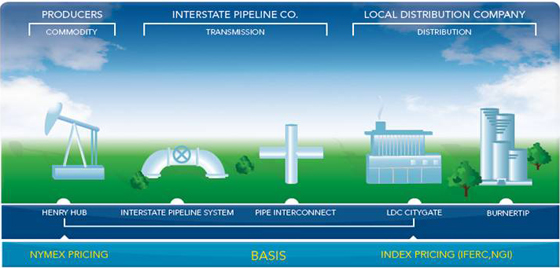

Index Buying (w/ Fixed Basis) NYMEX PLUS BASIS

Average Henry Hub settlements over the delivery period. Most suitable for industrial companies and those with appetite for risk in order to achieve the lowest possible rate. By fixing you basis you ensure that the Index price you receive is verifiable and accurate.

Index with Fixed Price Trigger

This allows companies to take advantage of current market conditions and pricing with the option of locking in a price at a later time. Companies considering this option should be able to handle a moderate degree of risk.

Full Swing

This Full Requirements option allows Customers to pay the same price regardless of usage.

Percentage Swing

- Customer notifies Supplier on how much natural gas they intend to use and they are required to stay within this percentage of consumption in order to receive the contracted rate. Companies considering this option should be able to handle a moderate degree of risk or have a good handle on their usage needs during the contract period. Choosing this option enables Customers to receive a more aggressive price.

- Does my contract protect me from variation is my usage?

- Am I a Transportation Customer?

- Is Storage & Balancing included in my current price?

US Grid Energy helps you navigate these and other questions while educating you along the way.

![]()

Risk Averse

Need 100% Budget Certainty. Hedge All Volumes

Semi-Risk Averse

Prefer Budget Certainty, but willing to take some risk to try to beat the market

Semi-Risk Taking

Prefer trying to beat the market to having a known cost

Risk Taking

Only concerned about beating the market. Float with Index and only hedge opportunistically